The resale market is poised to surpass fast fashion sales within 10 years.

Yes, you read that correctly. According to Doug Stephens, founder and president of retail industry consultancy Retail Prophet, “The explosion in resale fashion, driven by brands like The Real Real, Poshmark and others, positions resale to overtake fast fashion within a decade.”

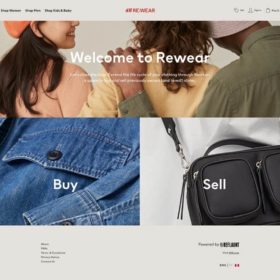

In fact, according to online retailer ThredUp’s 2020 report, resale is predicted to be valued at $64 billion in four years. And now, an unlikely retailer is making a splashy entrance into the resale market alongside scrappier sites like Depop and Poshmark. Fast fashion mecca H&M just launched H&M Rewear, a resale platform where people can buy and sell items from any brand.

So how did thrifting go from a casual trip to Value Village into a full-blown fashion frenzy?

View this post on Instagram

For one, we’re in the era of conscious consumerism. In the last five years, the number of young buyers who prefer to purchase from sustainable brands has increased from 57 to 72 percent according to ThredUp.

Gen-Z and millennial shoppers have not only gravitated towards retailers focused on sustainability, but have also embraced thrifting. Many experts attribute this shift towards second-hand shopping to the environment younger shoppers have grown up in — climate change is a topic this demographic has heard about for years, and supporting eco-friendly brands and thrifting allows them to feel they are contributing to the movement.

Saving money has also become a priority for Gen-Z buyers, as “1 in 2 consumers care more about seeking value in their purchases than before the pandemic,” per ThredUp’s 2021 resale report. Stephens attributes this to the financial realities confronted by many young consumers, as they now “face unique economic challenges relative to previous generations, as they have suffered not one but two major economic crises in their formative income-earning years.”

However, it might be the uniqueness of thrifting that’s the biggest motivator for some Gen-Z shoppers. Second-hand shopping is fuelled by “the thrill of the find,” and can earn its wearer a certain cachet. Thrifting has become almost a lifestyle — “Oh this? It’s vintage” feels emblematic of the way many young shoppers express their identity. As Stephens puts it, “resale is no longer merely a cyclical fad but a fashion mainstay for a new generation of consumers.”

While some labels have launched clothing rental programs like California brand Vince, and others are integrating recycled materials into their products like Hunter Boots and Allbirds, resale has outpaced them all in a rapidly growing list of traditional retailers (such as Etsy, Farfetch and now H&M) embracing second-hand clothing.

H&M Rewear, the Swedish conglomerate’s new resale initiative, rolled out exclusively in Canada on September 7. Similar to other resale platforms, individuals can buy and sell any piece of clothing from any brand, including H&M. For payment, sellers have the choice between receiving a direct deposit or an H&M gift card with an added 20 percent value.

This move by the brand no doubt signals a yearning for a piece of the fast-growing resale market, Stephens says, noting a desire from fast fashion retailers to “counter their negative impact on the environment by promoting resale and re-use” with programs like these.

And it’s not hard to understand why. Fast fashion and fashion resale are naturally opposites — where one works to reduce environmental pollution and waste, the other directly fuels it with clothing that is not crafted for longevity. As brands like H&M have pioneered and perfected the fast fashion system, they shoulder responsibility for its environmental impact. “The fact is fast fashion companies need to produce less,” says Sage Paul, executive and artistic director of Indigenous Fashion Week Toronto, who calls programs like this one “Band-Aid solutions for the mess” fast fashion brands helped create.

That being said, as a fast fashion leader, H&M has been attempting to improve its environmental footprint for many years. In 2010 the retailer launched its Conscious Collection which uses 50 percent “sustainably sourced materials.” Since then, the company has also vowed to become climate positive by 2040 which includes “avoiding harmful chemicals, fossil-based energy sources and single-use packaging”. They’re also making the switch to using entirely sustainable fabrics by 2030 such as Circulose® made from 100 percent discarded cotton and Vegea™, a fake leather created from grapes. They’ve also set up clothing recycling bins in stores, invested in technologies like the cotton recovery startup Renewcell and created a supply chain sharing platform Treadler. H&M has even named its former sustainability chief as CEO.

Sarah Jay, founder of All Earthlings Consulting and conceiver of the documentary Toxic Beauty, acknowledges the brand’s strides in terms of sustainability despite seeing H&M’s foray into resale as “a clear attempt at monopoly and an acknowledgment of the sector’s potential for profitability.” Jay says: “Compared to their fast fashion peers, H&M is undoubtedly leading the way in terms of textile innovation. They are making adjustments and improvements. Let’s hope that their resale platform leads to a broader shift in their business model, the definitive end of fast fashion and the excessive use of virgin fibres to create new garments.”

The truth is there may be no tidy solution to the question of how to balance our desire to shop and love of fashion with an increasingly urgent need to take care of our planet. While consuming more mindfully is more important and popular than ever, shoppers have to continue keeping brands accountable about their environmental footprints — and whether their sustainable initiatives are truly genuine or just greenwashing. But, producing less is a good start.

The post Resale Is the Future of Fashion appeared first on FASHION Magazine.